Are you investing in the stock market and feeling overwhelmed by all of the news, opinions, and stories surrounding your investments? Do you need help making decisions based on emotions rather than what's best for your financial goals?

If so, then this blog post is for you. Investing can be tricky, but understanding how to avoid emotional investing will help minimise some of that aggravation. Here we'll discuss why we need to separate our feelings from our decision-making process and provide tips for being mindful when it comes to investing.

Understand the Psychology of Investing

Investing can be stressful, and it's easy to become overwhelmed by the news and opinions swirling around us. This can lead to emotional investing, where decisions are based on our feelings rather than what is best for our financial goals. It's important to recognise that this behaviour isn’t effective in achieving long-term success with investing.

To avoid emotional investing, we need to understand the psychology of investing and how our emotions can affect our decision-making process.

Emotions are natural, and it’s important to acknowledge that feelings can sometimes influence our actions. Fear and greed are two common psychological triggers that can lead to emotional investing.

Fear can cause us to make quick decisions out of uneasiness. We may be tempted to sell our investments at the first sign of trouble or invest in something too risky for our financial goals. Conversely, greed can lead us to make irrational purchases with unrealistic expectations of the returns we may receive.

Understand How Emotions Impact Your Investment Decisions

It is easy to become overwhelmed by the news, opinions, and other people's stories surrounding investments. This can lead to emotional investing – making decisions based on our feelings rather than what’s best for our financial goals.

We’ve all been there – the stock market takes a dip, and we feel gripped by fear, so our impulse is to sell off and get out of it before things get any worse. Or maybe we experience FOMO (fear of missing out) when stocks are soaring, and we jump in without researching or considering our long-term financial goals.

Understandably, we want to protect our investments and ensure safety – but this emotion can oft to poor decisions.

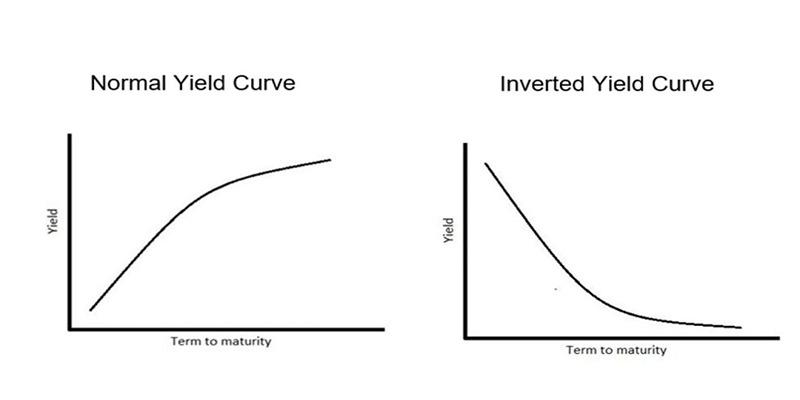

It’s important to remember that the stock market is volatile, and it can be difficult to predict the future.

While it’s natural to experience emotions when investing, it’s essential to understand how they could impact our decisions to make informed and educated choices that are best for our financial success.

Know When to Take a Break from the Market

It's natural to become overwhelmed when managing investments, especially if the market is volatile. It might be time to take a break if you are constantly glued to your financial newsfeeds and getting caught up in the rhetoric.

It's important to recognise when our emotions influence our investment decisions and act accordingly. You may have the best intentions to make rational decisions, but if you're feeling anxious or desperate—even if it's just for a few moments—it could lead to poor choices that don't align with your goals.

Before investing any of your money, take some time away from the market and return to it with a clear head.

Set Financial Goals and Stick To Them

When investing, having a clear financial plan and knowing your goals is the best way to ensure you stay on track. It’s important to consider what kind of returns you need to reach those goals, as well as how much time you have to get there.

This will give you a framework for making decisions and help minimize the emotional tug-of-war that can often arise when we’re asked to make a financial choice.

Find a Financial Planner or Mentor to Help Guide Decisions

Investing in the stock market can be intimidating, especially when emotions come into play. Having a financial planner or mentor to help guide decisions helps to ensure that they are based on what is best for your portfolio rather than simply following your feelings.

A third-party opinion also allows you to consider different options and strategies without feeling overwhelmed.

Consider Long-Term Goals Instead of Short-Term Gains

When investing, it's important to focus on your long-term goals instead of short-term gains is important. This means that you should be looking at what will benefit you in the long run rather than trying to maximise your returns in a short amount of time. The stock market can be unpredictable, and relying on short-term gains means that you could be placing yourself in a vulnerable position.

By focusing on your long-term goals, you can make informed decisions that have been researched and carefully thought out. This will ensure that any investments you make will align with what is best for your financial future. Additionally, it's important to remember that sometimes it's okay to lose money to achieve bigger gains down the line.

Understand Your Emotions

Getting caught up in emotions when investing can be easy, especially when you experience losses. It is important to remember that these feelings are normal and to not allow them to cloud your judgment.

The best way to combat this is by understanding your emotions and being mindful of your decisions. Take time to reflect on why you made certain investments and evaluate if it was for the right reasons.

FAQs

Why am I so emotionally invested?

It is common for investors to feel overly attached to certain stocks. This emotional attachment can lead to irrational decisions, such as buying and selling stocks based on your feelings rather than what the market dictates.

What are the risks of emotional investing?

When you make decisions with your emotions, it often overrides your logic and common sense. This can lead to costly mistakes such as staying in a losing trade too long or buying high without doing the necessary research on the stock.

How do you trade without emotions?

The first step in trading without emotions is to build a solid investment strategy. Take the time to create well-defined risk management rules and stick to them.

Conclusion

It is important to recognise when you are emotionally investing in an investment and adjust your strategy accordingly. As an investor, it’s easy to get carried away at the moment, so it’s important to take a step back and look at your investments objectively.

Avoiding emotional investing can help you stay on track toward achieving your financial goals. If you feel like you are losing control of your emotions while investing, consider using tools such as asset allocation models and stop-loss orders to keep yourself grounded.